How To Claim Money And Assets If Someone Dies Without A Will In Malaysia

It could take up to five years to go through the entire process.

Cover image via kanchanachitkhamma/Canva & wattanaracha/Canva Pro

Cover image via kanchanachitkhamma/Canva & wattanaracha/Canva ProOne topic we don't talk about much in Malaysia is estate planning or will writing. However, it's something important that Malaysians should become more aware of.

So, what happens if a loved one dies without a will — how do family members claim money and assets of the diseased?

When someone passes away without a will, it can take up to five years for their assets to be properly passed on to their family members. Without a will or estate planning, disputes can also arise, delaying the process. Lastly, if the deceased did not inform anyone about their possessions, the beneficiaries may not even know it exists.

Here's a closer look at what happens to a person's estates when he or she passes away without a will in Malaysia:

First of all, the death will be classified as 'intestate', a.k.a. death without leaving a will or instructions on estate distribution — this applies to savings in bank accounts, properties, investments, and other assets.

Next, depending on whether you're a Muslim or non-Muslim, intestacy (inheritance) laws will determine how your estates are distributed.

However, this does not include Employees Provident Fund (EPF) or insurance payouts, as nominees for those would have been chosen. That's why EPF members are encouraged to appoint a Nominee to facilitate and expedite the administration of EPF savings by the appointed Nominee after their demise.

For nomination made by Muslim members, the EPF savings will be administered and distributed according to Faraid Law. An EPF Nominee will be the Executor or Administrator of the said savings, and the same goes for Takaful. For nominations made by non-Muslim members, the savings will be administered and distributed according to the member's instruction.

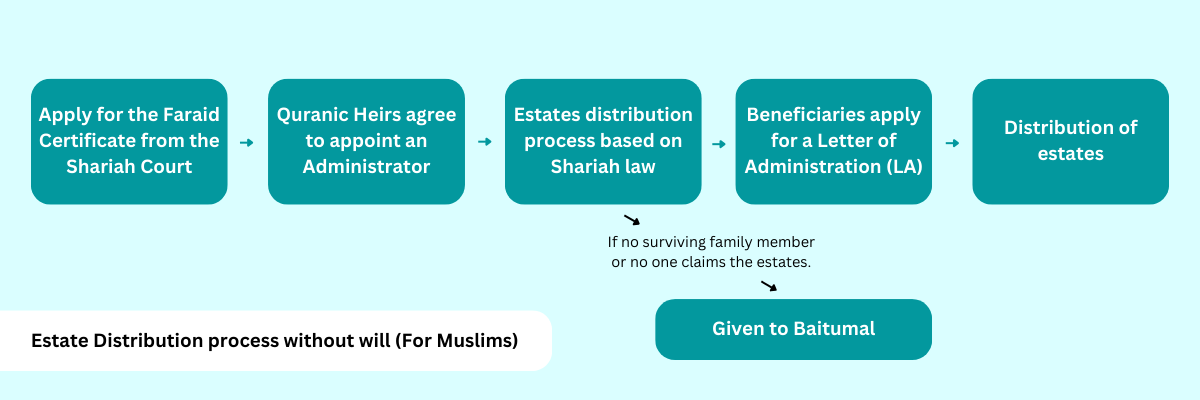

For Muslims:

Surviving family members will need to apply for Faraid Certificate from the Shariah Court. Next, all rightful Heirs must mutually agree to appoint the same Administrator. The estates will be distributed based on Shariah law — it will be given to Baitulmal (Islamic financial institution) if there are no surviving family members or no one claims the estates.

Beneficiaries have to apply for a Letter of Administration before the estates are distributed. The letter allows the person named to administer the estate of a deceased who has died without leaving a valid will.

Image via SAYS

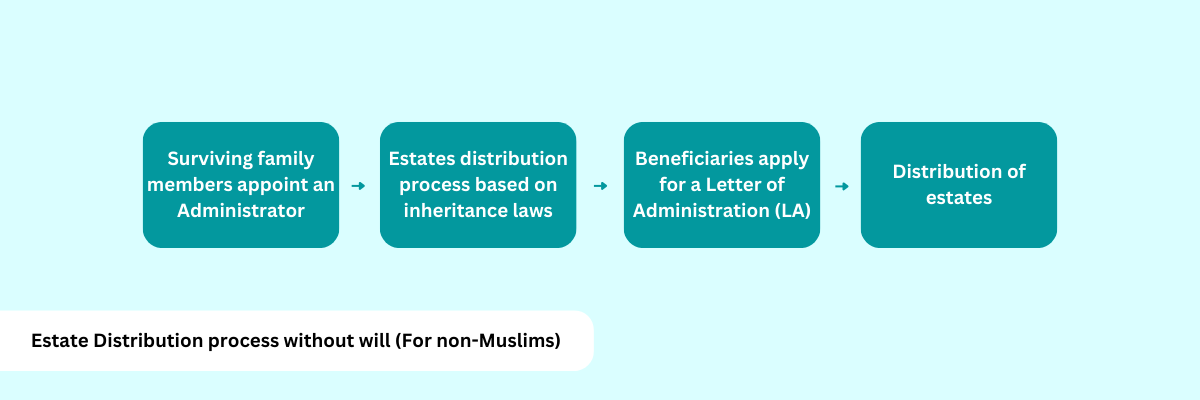

For Non-Muslims:

Surviving family members will need to appoint an Administrator. Similarly, beneficiaries need to apply for a Letter of Administration before the estates are distributed.

Upon which, the estates will then be distributed to the beneficiaries based on Distribution Act 1958 after deducting the funeral expenses and outstanding debts.

Image via SAYS

On top of that, for both Muslims and Non-Muslims, the Administrator will need to find two sureties, whose role is to guarantee the same value of assets and ensure the estates are properly distributed. However, no sureties are needed if AmanahRaya is appointed as the Administrator for estates with a gross value of RM600,000 or below.

In Malaysia, three institutions have the power to issue the Letter of Administration: AmanahRaya, the Small Estate Distribution Unit of the Department of the Director-General of Lands and Mines, and the High Court (Civil)

AmanahRaya, a premier trustee company wholly-owned by the government of Malaysia, can be appointed as an Administrator for both Testate and Intestate estates regardless of value. As a one-stop centre for wealth and estate planning, AmanahRaya will professionally compile and manage deceased's assets, settle any debts, and distribute the remaining assets to the rightful beneficiaries.

So, what happens to estates that are not claimed — where do the money and assets go?

Image via Alex Suprun/Unsplash

Contrary to popular belief, estates are not "frozen" at AmanahRaya.

When a person passes away, the estates will be in the name of the deceased until their loved ones begin the process of administering it. The estates will not go directly to AmanahRaya.

For instance, if Ahmad leaves behind property, cars, bank deposits, and stocks when he dies, all assets will be frozen at the location or agency where they are being kept. The ownership of the assets still belongs to Ahmad until his surviving family members obtain a Letter of Administration. As long as this step is not done or delayed, the assets will continue to be frozen.

To prevent this from happening, every individual should know the basics of estate management. Better still, you should plan for your inheritance in advance by including a will as part of your wealth and estate planning instrument.