Lifestyle

Lifestyle"So You Have RM1,000" — Here's A Simple Guide On How To Start Investing In Malaysia

There's actually a lot you can do with RM1,000 in Malaysia.

Investing might sound like something reserved for those with deep pockets, but guess what? You can start with just RM1,000.

Yeap, you heard that right — RM1,000 is more than enough to get you started on your journey to growing your money. And while investing may seem daunting at first, we've helped you narrow down a few simple options you can start with.

None of the information presented below constitutes investment advice. Please consult a certified financial consultant before investing.

Image via SAYS

1. Fixed Deposit (FD)

What to expect: Low Risk | Low Return (1.85% to 3.5% per year)

One of the easiest ways to start investing is with fixed deposits, where you place a set amount of money and you get a fixed return after a certain period. The periods for fixed deposits range from one month to 60 months, and you usually get a higher return the longer the period.

How to get started: Visit your bank to set up a fixed deposit account; some banks allow you to open FD accounts and make FD placements easily through mobile banking.

Image via SAYS

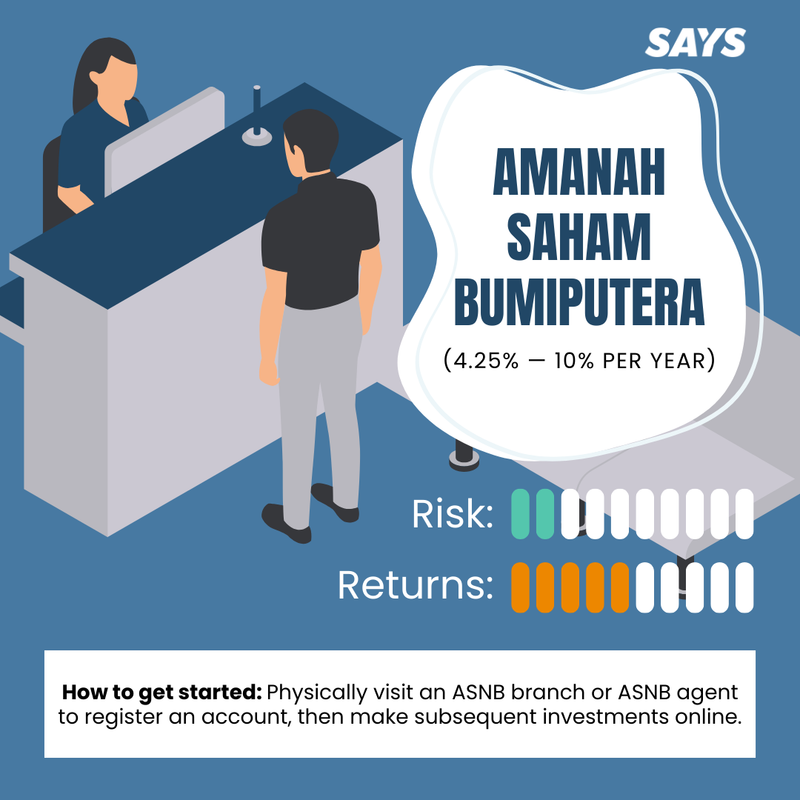

2. Amanah Saham Bumiputera (ASB)

What to expect: Low Risk | Medium Return (4.25% to 10% per year)

Want a low-risk investment with decent returns? ASB is a unit trust fund for bumiputeras that allows you to start investing from just RM10. The good thing is that ASB has never delivered negative returns, and doesn't have any sales or redemption charges.

How to get started: Physically visit an ASNB branch or ASNB agent to register an account, then make subsequent investments online.

Image via SAYS

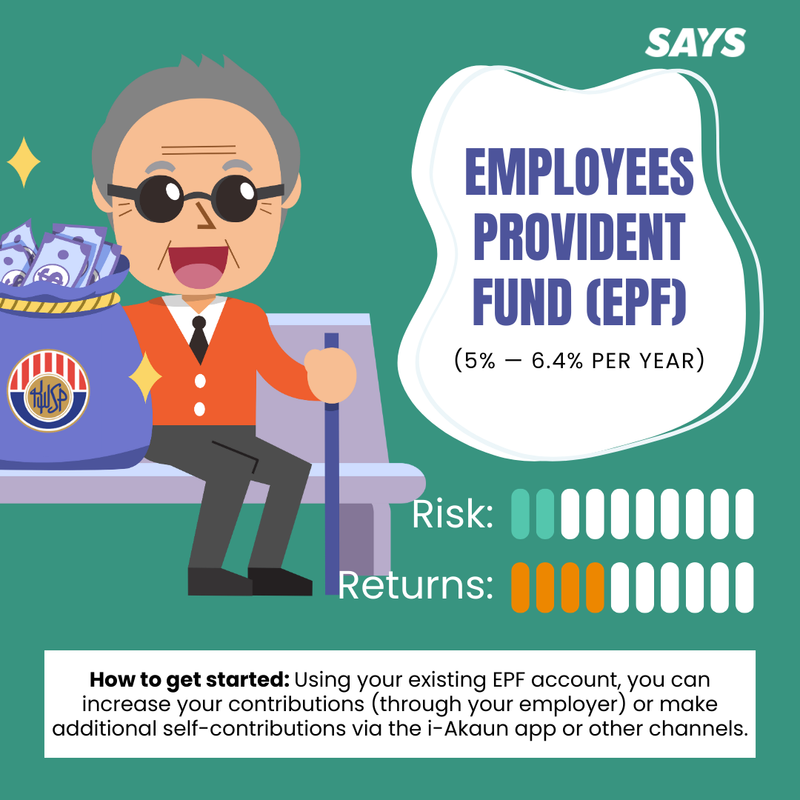

3. Employees Provident Fund (EPF)

What to expect: Low Risk | Medium Return (5% to 6.4% per year)

If you are looking to invest into the future, EPF is a good way to build up a retirement fund. You'll also get to enjoy tax relief, but the downside is that you can't withdraw the funds before the age of 50, 55, or 60. However, you can use portions of your EPF savings for certain purposes like medical emergencies, housing, marriage, and higher education.

How to get started: Using your existing EPF account, you can increase your contributions (through your employer) or make additional self-contributions via the i-Akaun app or these other channels.

Image via SAYS

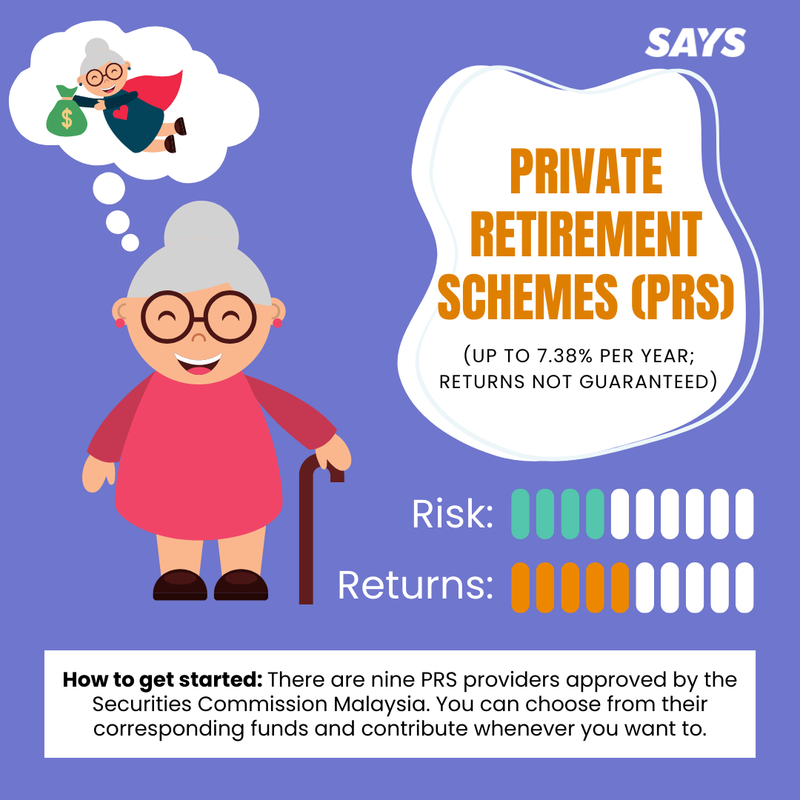

4. Private Retirement Schemes (PRS)

What to expect: Low to Medium Risk | Returns not guaranteed

PRS allows you to invest in approved unit trust funds for retirement. Similar to EPF, it's not easy to withdraw your funds — there's an 8% tax penalty for early withdrawals. But the good thing is you can claim tax relief of up to RM3,000 when you invest in PRS up to 2025.

Returns for PRS aren't guaranteed, and they come with upfront sales charges and annual management fees. However, high-performing funds have achieved up to 7.38% returns per year (over five years).

How to get started: There are nine PRS providers approved by the Securities Commission Malaysia. You can choose from their corresponding funds and contribute whenever you want to.

Image via SAYS

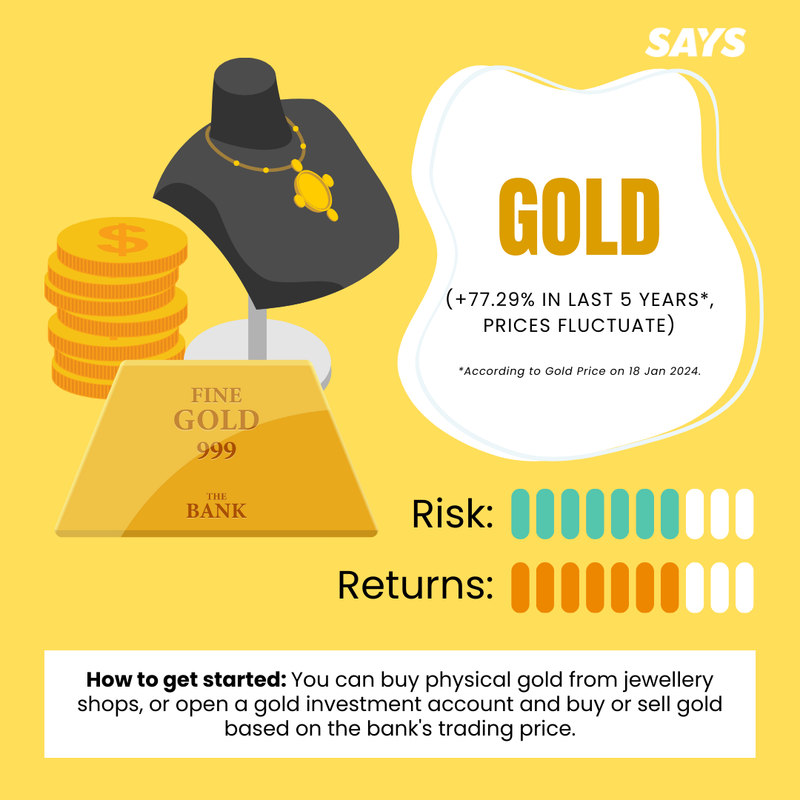

5. Gold

What to expect: High Risk | High Returns

According to Gold Price, gold has increased by 77.29% in value over the past five years. While gold has the potential hedge against inflation, the returns are not necessarily a given, as prices may fluctuate.

How to get started: You can buy physical gold from jewellery shops, or open a gold investment account and buy or sell gold based on the bank's trading price. Do note that the bank's trading price for gold may not necessarily reflect the market price.

Image via SAYS

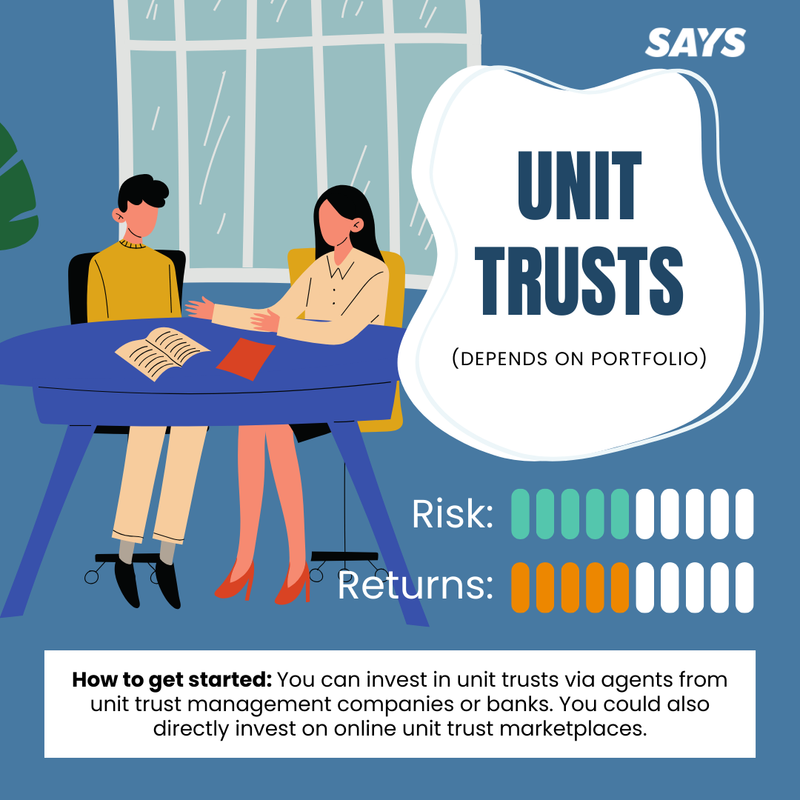

6. Unit Trusts

What to expect: Low to High Risk | Returns depend on portfolio

Unit trust funds are a good way to start investing. They pool funds from investors and are managed by professional fund managers, who make investment decisions to achieve your goals — be it investing for retirement or growing your capital quickly. Do note that unit trust funds with high potential returns also come with high risks; make sure you also take into account sales fees and other costs.

How to get started: You can invest in unit trusts via agents from unit trust management companies or banks. You could also directly invest on online unit trust marketplaces like FSMOne or EPF i-Invest.

Image via SAYS

7. Robo-advisors

What to expect: Low to High Risk | Returns depend on robo-advisor and portfolio

In recent years, robo-advisors like Stashaway, MYTHEO, and Raiz have risen in popularity. Instead of a person managing your fund, robo-advisors use algorithms to handle your portfolio for you. They usually come with lower management fees, and allow you to invest with just a few ringgit.

How to get started: Sign up with a robo-advisor, complete a risk assessment, and let the platform handle your investments based on your risk tolerance.

Image via SAYS

8. Cash Management Solutions

What to expect: Low Risk | Low to Medium Returns

Cash management solutions tap into money market funds to deliver returns that are on par or higher than FDs. Some examples you may be familiar with include StashAway Simple, Versa Cash, KDI Save, and Touch 'n Go's GOInvest.

The benefits of these solutions include: lower risk, higher potential returns than FD, low investment amount, convenience, and being able to withdraw any time. However, while the risk is low, returns are not guaranteed and funds are not protected by the government.

How to get started: Download one of the apps, sign up, then deposit and withdraw any time.

Image via SAYS

9. Foreign Currency

What to expect: Moderate to High Risk | Returns vary

If you feel like keeping all your money in ringgit is risky, you can diversify your investments by converting your extra ringgit into other foreign currencies. However, currency values can be volatile and influenced by various factors. Stay informed about global economic trends before making investment decisions.

How to get started: You can open a foreign currency account with a bank or explore forex trading platforms. If you prefer something simpler, you can use the Wise multi-currency account, which lets you hold 53 different currencies and even comes with a debit card for overseas spending.

Image via SAYS

This is by no means an extensive list of ways you can invest RM1,000 in Malaysia — we haven't even touched on stocks, cryptocurrency, peer-to-peer lending, and more!

Nevertheless, the rule of thumb when it comes to investing is always do your research, know and understand where you're putting your money, and only invest what you can afford to lose.

If you still have debts like credit cards, bank loans, and other high-interest loans, make sure to prioritise paying those off first. Next, try to build an emergency fund that can tide you over for at least three months. Once you have this in place (and don't forget insurance), feel free to try your hand at investing in whichever option suits you the most.

Ultimately, don't rush yourself — investment takes time. Start somewhere, keep at it, top up when you have extra funds, and you'll gradually build up your own investment portfolio.

Cover image via

Cover image via